SMS, USSD and WAP Mobile

Payments

SMS Payments are one of the easiest ways to pay for items

since there are no passwords or account numbers to remember. You do not even

have to have a bank account, which is one reason SMS payments are so popular in

developing countries. It usually only takes less than a minute to complete a

purchase. This service is perfect for bill payments, money transfers, deposits

and withdrawals, accessing account information and to confirm transaction

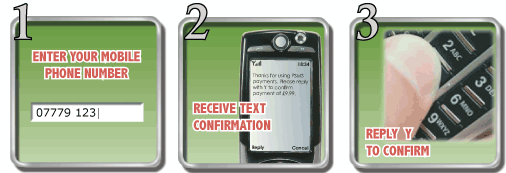

status. There are three ways in which SMS Payments can be sent. The primary way

is through a website and a code which the consumer is sent via a web page. Then

the consumer sends this code to the text number and they pay for their

purchase. Another way is entering their phone number into a website. The

retailer then sends a text with a code and the consumer enters this code to

purchase online items. The last way is through direct text and this is used

primarily by charities. The consumer just sends a text to an advertised number

and their contribution is received by the charity. SMS payment options are

perfect for people without smart phones since only texting is required.

USSD or Unstructured Supplementary

Services Data

This mobile payment option is only available on GSM carrier

networks which currently are AT&T and T-Mobile. This service can be used for many mobile

banking needs such as balance inquiry, money transfers, bill payments and the

purchase of airtime minutes. The advantage of USSD versus SMS messaging is that

it is more secured because it is “real-time connection unlike SMS which stores

and forward protocol (Clickatell’s)”. This

service usually does not cost the end user any fees. The disadvantages are that “Phase

2 functionalities include session based communication and only work on updated

GSM phones and most global networks are still not updated to Phase 2 USSD (Van,

1)”· GSM networks are not standard in developing counties so they do not

support USSD services.

WAP or Wireless Application Protocol

In order to use a WAP based mobile payment, you will need to

download an application and install it on your smart phone. This will then lead

you to a particular web page that will be displayed on your mobile phone. This

makes paying for items very easy and allows the consumer the benefit of being

able to keep track of their purchases through Follow-on sales. “These pages can

be bookmarked easily by consumers, because they have specific URL, and it is so

easy to re-visit the pages or share them. (Admin, 1)”. WAP payments are quick

and help ease consumer’s security concerns by paying predictable way on one site. Some of

the disadvantages of using WAP mobile payments is that the small screen to view

webpages on some smartphones makes it hard to navigate, limited availability of

service in some areas since you must be connected to the Web and the price of smartphones makes it unaffordable to some people.

Van. Long. “Use of USSD technology in Mobile Banking”.

Mobile-Finncial.com. 08 Aug. 2009. Web. 18 Sept .2013. http://mobile-financial.com/blogs/use-ussd-technology-mobile-banking

Lumia. “How do SMS Payments Work for Users?”. Mobile

Transaction. 07 April 2013. Web. 18 Sept 2013. http://www.mobiletransaction.org/how-do-sms-payments-work-for-users/

“Interact with Unstructured Supplementary Service Data

(USSD)”. Clickatell. 2013. Web. 18 Sept. 2013. https://www.clickatell.com/clickatell-products/enterprise-products/ussd/

Admin. “Mobile web payments (WAP)”. Varshyl. 12 Feb. 2013.

Web. 18 Sept. 2013. http://www.varshyltech.com/article/mobile-web-payments-wap/

SMS texting appears to be an interesting concept; however, I just have 2 questions:

ReplyDelete1) How are customers charged when doing an SMS transaction? So do they get charged on their bill at the end of the month? Or is it an actual program where they are able to give their credit cards initially and always use SMS payments?

2) Is the concept of SMS texting slowly going away? I can't remember the last time I have seen a commercial on TV telling me to text a certain number and code.

Great questions Adam. The price for making SMS mobile payments can vary depending on the company accepting the payments and the text messaging service the consumer has. The fees can go as high as $9.99 or could be free. The fee that is charged by the SMS payment provider is added on the purchase price. I do believe that with the influx of smartphones that SMS mobile payments are going away in this country. This payment type is still very popular in developing counties. The last time I saw a commercial for texting in contributions was after Katrina hit in 2005.

DeleteThis article was very knowledge - I had no idea you could pay via text. Yet SMS payments concern me. I just made an online payment with my debit card and I didn't trust it. There's no way I would trust sending a 4-digit code via text linked to my bank account. What if someone took your phone? Could they not just go on a buying splurge? I disagree with that sort of method.

ReplyDeleteHowever, I do like the method of being texted your balance an being able to make transfers. It still worries me that my information would be easily accessible. But if I'm on the go and I run out of gas, I need to know how my money I have in my account. There was never a time when I was in an emergency and thought, oh I wish I could pay faster.

Maybe I'm just old school, but I don't like having so many loopholes to my banking account. I have to protect my mail, my laptop, my phone, my card, etc. at all times for fear someone could hack into my personal technologies and ruin my life in one day. Text payments (similar to online payments) are a good idea, but I'm not trying it out until there's initial problems that someone else has to learn from in order for them to fix it.

I agree that SMS payments are not for me either. Security concerns with any personal information is a huge concern for people. Just like having your wallet stolen can cause massive headaches and possible financial problems, so can having your phone stolen now. Our blog will focus on how security concerns are being handled in a future blog.

ReplyDeleteIs there a list of companies that offer this service on the internet; is it just something that you have to see advertised or hear word of mouth? I guess I am old school as well. I heard on the radio one day that more phones are being hacked with an increasing amount of charges. I remember thinking to myself how can money be charged to a phone, this helps explain it.

ReplyDeleteWe will also have more about what companies are doing to help protect your private information in another blog.

DeleteIts really unbelievable what we can accomplish with a smartphone. That being said making payments to any of my accounts isn't one of them. I still don't feel safe enough to use my phone to pay accounts. Phones aren't like wallets or purses. They are always laying around, easily accessible to the wrong person to get a hold of. Until they become a little safer to use ill stick to my home pc.

ReplyDeleteI understand your concern and I felt the same way up until last year. It all about convenience for me. We will be doing a blog about security concerns and remedies soon, maybe that will help ease your mind into trying mobile payments.

Delete